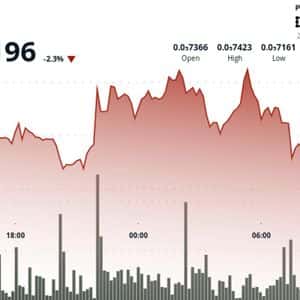

October’s anticipated “Uptober” momentum and seasonal bullish expectations appear to have taken a backseat. Instead, US President Donald Trump’s aggressive tariff threats and trade remarks toward China took center stage, and dictated Bitcoin’s sharp price swings and investor emotions throughout the 0 Market’s Emotional Rollercoaster Trump’s China-related rhetoric in October 2025 reverberated through Bitcoin’s (BTC) price action and on-chain sentiment, as the asset continues to be sensitive to geopolitical 1 Net Unrealized Profit/Loss (NUPL) indicator, which measures aggregate market psychology through unrealized gains and losses, reflected investors’ shifting emotions throughout the 2 October 10, when Trump threatened 100% tariffs on Chinese imports, Bitcoin tumbled by 8.4% to around $104,800.

NUPL simultaneously dipped below 0.50, a level historically associated with rising fear and profit-taking. A few days later, as Trump adopted a softer tone on China, Bitcoin recovered toward the mid-$110,000 range while NUPL reflected cautious optimism. However, renewed tensions on October 14, which saw new export controls and port fees, ended up triggering another sell-off, which pushed both BTC price and NUPL lower 3 began to stabilize only after October 24, when news of Trump’s upcoming summit with his Chinese counterpart, Xi 4 climbed above $115,000, and NUPL started to 5 October 26, reports emerged that Trump might cancel the tariff plan, which further boosted confidence, and NUPL approached 0.52, indicating growing market 6 to this market volatility and sentiment swings, CryptoQuant stated that geopolitical shocks like Trump’s trade threats don’t just shake prices; they also “reshape market sentiment.” BTC Shorts Liquidated As Bitcoin rebounded , over-leveraged short traders got 7 asset now hovers above the $114,000 support zone, a level that recently acted as a strong area of buyer 8 to crypto analyst Ted Pillows, the next key step for it is to reclaim the $118,000 zone, which has repeatedly served as short-term resistance throughout October’s choppy trading.

A move above this threshold, he suggested , could pave the way for a new all-time high within the next one to two 9 everyone shares the growing 10 market expert, Ali Martinez, for one, warned that the asset could soon face profit-taking pressure, as the TD Sequential indicator has flashed a sell signal on the daily chart – a tool often used to identify potential trend exhaustion.

Story Tags

Latest news and analysis from Crypto Potato