Michael Saylor and the company he co-founded, Strategy (formerly MicroStrategy) , have become synonymous with Bitcoin following the company’s pivot to being a BTC treasury 0 the years, the company has grown to become the leading public company with the largest BTC holdings running into tens of billions of 1 the entire BTC stack now sits in major profit, speculation abounds as to what happens if the Bitcoin price falls to Strategy’s average buy 2 Strategy’s Bitcoin Holdings Strategy has been steadily purchasing Bitcoin for the past four years after Michael Saylor first introduced the idea back in 3 purchases have happened at intervals with varying amounts of BTC purchased at different points in the Bitcoin life cycle so far, causing its average buy price to fluctuate over 4 the time of writing, Strategy currently holds 641,205 BTC following its latest purchase on November 5 company had bought 397 BTC at an average price of $114,771 per Bitcoin, costing around $45.6 million in 6 buy brought the company’s average buy price to $74,057 per 7 total holdings of 641,205 BTC cost $47.487 billion, but with the rise in the Bitcoin price over the years , the company is seeing over $18 billion in profit so 8 to data from Bitcoin Treasures, the entire BTC holding is now worth $64.91 billion, translating to a 36.61% 9 the information above, Strategy’s BTC holdings remain firmly in profit and look to be a good move so far.

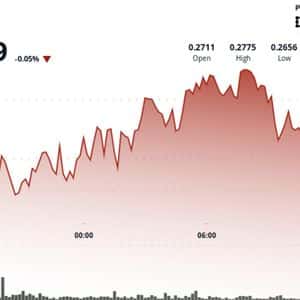

However, with the Bitcoin price crashing below $100,000 this week, questions abound as to what happens if the Bitcoin price were to crash to Strategy’s average 10 crypto community members on X (formerly Twitter) have speculated that this means that the entire holding gets liquidated, but this is not the case. Strategy’s BTC holdings cannot get liquidated by the price falling below its average price because it actually owns the BTC that it 11 the Bitcoin price were to fall below $74,000, the holdings would simply go into a loss, 12 price is now lower than where it was 13 the holdings to be liquidated, the company would have to sell off into the market, regardless of price, in order to pay back investors.

However, Saylor has said in the past that the company has no plans to sell its considerable BTC holdings anytime 14 numerous rumors that the company was selling its BTC, which Saylor has debunked, it has instead continued to buy, paving the way for other Bitcoin treasury companies in the space.

Story Tags

Latest news and analysis from Bitcoinist