A widely followed macro roadmap circulating on X early Friday, November 7, sets an explicit sequence of policy and market triggers that could define crypto’s trajectory into December—and frame positioning into 0 thread, posted by macro analyst Alex Krüger is unambiguous about the immediate constraint: “cautious stance until the government shutdown is resolved.” It is equally explicit about the upside if Washington finds a path forward, calling the shutdown’s resolution “bullish” for risk assets and saying for bitcoin to “Expect BTC +5% or more within 48 hours of deal.” The near-term hinge, in other words, is binary. A shutdown that lingers keeps risk pared back; a deal, by contrast, opens the door to what the thread characterizes as a quick relief 1 author’s base case on timing—“estimated to be resolved sometime between the end of next week and Thanksgiving”—extends that window into the back half of 2 framing matters for crypto because the same roadmap argues the December calendar is stacked with policy and flow headwinds that could complicate any rally that begins late this 3 Outlook For Year-End Of 2025 At the center of December sits the Federal Open Market 4 thread presently tags the December 10 FOMC outcome “hawkish,” explaining that “most Fed officials favor a pause as of now, which is not priced in at the moment,” while also acknowledging that “officials may change their stance on rates as economic data comes in and the month progresses.” The nuance is important: the policy signal, as currently envisioned, is tighter than markets are discounting, yet the sign itself could be revised as data crystallizes—if it arrives at 5 Reading: Caution In The Crypto Market: Expert Warns Of Bearish Phase Unfolding This November That caveat leads into a second unusual feature of this year-end: a potential data vacuum due to the ongoing US government shutdown.

“Omitted all upcoming economic data releases from the list due to uncertainty on release dates,” the thread notes, citing the shutdown’s impact on statistical 6 adds, “Will likely see no official economic data in November, and data resuming in December, with payrolls (jobs) on Dec//5 (a crucial data point for the FOMC decision).” An extended blackout followed by a compressed burst of releases would increase event risk around any single print, especially nonfarm payrolls, and could amplify volatility across risk assets, crypto included. A separate political appointment may intersect with the December meeting as 7 roadmap flags the “New Fed Chair nomination,” “estimated to be announced before the next FOMC, to influence the FOMC decision (it could also be soon after); bullish to very bullish.” Even if the timing slips to just after the meeting, the signaling effect around leadership and policy reaction functions would, in this framework, skew supportive for risk.

Tax-based flows complicate that picture for crypto assets 8 thread characterizes “Tax loss selling (crypto only)” as “bearish; all December, mainly last two weeks,” reasoning that crypto’s relative underperformance versus equities this year leaves room for harvesting that is “of particular importance given relative stocks-crypto performance.” Seasonal pressure late in the month would be consistent with prior years in which crypto saw localized December-to-January pivots as selling abated and re-risking emerged with the calendar 9 Reading: the shutdown’s resolution “bullish” for risk assets Another macro wildcard sits outside monetary 10 author highlights the “Supreme Court’s decision on Tariffs: most likely sometime in December, otherwise January, timing fluid,” and frames market odds as pointing to a ruling “against Trump, which would be extremely bullish IMO, although some argue such a ruling would be bearish.” The point is less about a one-way trade and more about the breadth of plausible paths: depending on the ruling and how forward-looking positioning is into the event, crypto could either extend a policy-led risk-on move or face a whipsaw if the outcome collides with 11 2025’s final weeks, the roadmap sketches a decidedly constructive macro backdrop next year, at least at the start. “2026: very bullish first half of the year, driven by accommodative fiscal and monetary policies.” For crypto, that forward anchor matters because it underwrites the notion that any December drawdowns from tax effects or a hawkish-leaning FOMC could be transient if the policy impulse turns easier into 2026.

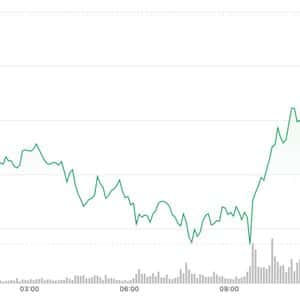

Tactically, the thread even proposes a short-term trade expression around the shutdown endgame: “For BTC, I think you can probably sell a spike into the shutdown resolution around $108k-$109k (~20 DMA) then enjoy a king’s holiday and come back in by year end.” At press time, the total crypto market stood at $3.36 12 image created with DALL. E, chart from 13

Story Tags

Latest news and analysis from NewsBTC