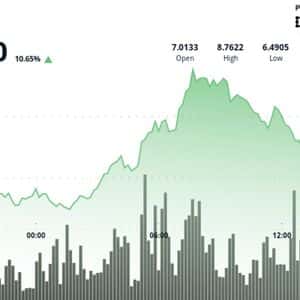

XRP is down another 5% on Friday, November 7, trading at $2.18 underperforming the broader crypto market which is 2.7% in the 0 downward momentum continues despite the overall activity on the XRP Ledger (XRPL) witnessing the highest levels in eight months . Nonetheless, the sharp downtick could be a direct result of the ongoing rapid increase in wallet creations, which have often preceded significant price movements for the crypto. Notably, Ripple’s latest announcements at its flagship event failed to sustain bullish momentum and became more of a “sell the news” 1 traders speculating on how the asset might move in the following days, Finbold turned to its AI prediction agent to see where XRP might stand by the end of the 2 to the forecast, the asset is only witnessing a short-term correction, being set to recover 5.22% and trade at $2.28 by November 3 price forecast.): GPT-4o, Claude Sonnet 4, and Gemini 2.5 4 the three, Claude Sonnet 4 was the most optimistic, projecting the price could surge to $2.45, marking a 12.9% 5 was the complete opposite, forecasting a price of $2.10, implying a 3.67% downside.

GPT-4o was bullish but more conservative than Claude Sonnet 4, estimating a price target of $2.30, a 5.5% upside 6 composite result thus reflects a mildly bullish consensus, suggesting confidence in continued upward momentum despite some differing model 7 price action Looking at it from a technical point of view, XRP has slipped below its 30-day simple moving average ( SMA ) of $2.47 and its 200-day SMA of $2.63, which suggests deepening 8 the same time, the token’s relative strength index ( RSI ) now sits at 37.09, that is, not yet oversold but not signaling a clear reversal either. What’s more, with the price stuck beneath the $2.20–$2.39 Fibonacci support range, a drop toward $1.90–$2.00 remains possible if selling 9 worth mentioning is that capital continues to move away from high-risk assets.

Indeed, the CMC Altcoin Season Index has plunged 61.82% over the past month, way into “Bitcoin Season.” The shift has left XRP more vulnerable, as evidenced by its 5% pullback notably exceeding Bitcoin’s ( BTC ) 2.5% slide. Accordingly, the key short-term question for traders is whether XRP can defend the $2.00–$2.10 zone as bearish sentiment 10 image via Shutterstock

Story Tags

Latest news and analysis from Finbold