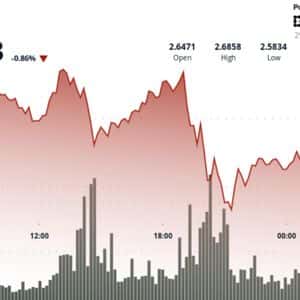

Gold’s price climbed to new all-time highs in mid-October, breaking above $4,000/oz for the first time in history, before eventually reaching a peak of $4,342/oz. The yellow metal’s rally came at a time when BTC was enduring a flash crash that pulled its price down to $101,000 very 0 contrast between gold’s strong rise and BTC’s pause has caught the attention of crypto commentator Sykodelic, who believes the pattern is about to 1 his latest analysis, he suggests that gold may have already peaked while Bitcoin is preparing for its next major rally. Gold’s Blow-Off Top And The Cycle Inversion Sykodelic pointed to the nearly 18-month inverse correlation between gold and Bitcoin as the foundation of his 2 analyst’s chart, which overlays both assets, shows a pattern of alternating expansions and 3 time gold surged, BTC entered a cooling phase, and whenever gold stabilized or corrected, Bitcoin followed with a major upward 4 most recent sequence places gold in what looks like a blow-off top 5 blow-off top structure is a parabolic rally followed by exhaustion, confirmed by the precious metal’s current correction below its all-time 6 phase has always correlated with the point of transfer between the two 7 periods when retail enthusiasm peaked in gold, Bitcoin’s price quietly consolidated at support 8 timing, according to Sykodelic, is “almost down to the day.” The comparison chart below shows the synchronization.

Gold’s breakout phases, shown in green channels, are followed by cooling phases highlighted in red, and Bitcoin’s chart below follows the same rhythm with a slight time 9 structure implies that Bitcoin’s recent consolidation around the $110,000 to $115,000 range may be mirroring the early stages of gold’s last expansion phase in early 10 Does This Mean For Bitcoin? From a technical perspective, this setup means that Bitcoin is now entering the same pattern gold just completed, with momentum building at the lower boundary of its new green channel highlighted in the chart image 11 implies that a breakout could lift Bitcoin well above its current all-time high, setting up what is another crypto rally similar to gold’s move earlier this month.

“It’s Bitcoin’s turn to pump very hard,” Sykodelic 12 channel projection on his chart shows an advance that will see the BTC price breaking above $140,000 by the end of 2026 before the next capital rotation into 13 course, this all depends on how market news and events play out in favor of the crypto 14 the time of writing, Bitcoin is trading at $114,196, up by 6% in the past seven days. Gold, on the other hand, is trading at $3,930, down by 9.5% in the same 15 divergence might be the first sign that the capital rotation is already underway.

Story Tags

Latest news and analysis from Bitcoinist