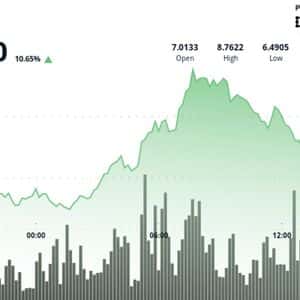

BitcoinWorld Ethereum Price Prediction 2025-2030: Will ETH Reach $10k? As Ethereum continues to evolve beyond just a cryptocurrency into a comprehensive decentralized computing platform, investors worldwide are asking one crucial question: Can ETH realistically reach $10,000? Our comprehensive Ethereum price prediction analysis examines the technical indicators, market fundamentals, and ecosystem developments that could drive ETH to new heights by 0 Ethereum Price Prediction Fundamentals Making accurate Ethereum price predictions requires analyzing multiple factors that influence market 1 transition to proof-of-stake through Ethereum 2.0 has fundamentally changed the network’s economics, reducing new supply issuance while increasing staking 2 shift creates a deflationary pressure that could significantly impact long-term price 3 Price Forecast 2025: The Next Major Milestone By 2025, Ethereum is expected to have fully integrated numerous protocol upgrades that enhance scalability and reduce transaction 4 ETH price forecast for 2025 considers several key drivers: Increased institutional adoption of Ethereum for decentralized applications Growing DeFi and NFT ecosystem expansion Regulatory clarity in major markets Technical improvements from ongoing network upgrades Scenario 2025 ETH Price Prediction Probability Conservative $4,000 – $6,000 40% Moderate $6,000 – $8,000 35% Bullish $8,000 – $12,000 25% Ethereum 2026: Sustaining Growth Momentum The Ethereum 2026 outlook depends heavily on the successful implementation of sharding and other scalability 5 Ethereum can maintain its dominant position in the smart contract platform space while reducing gas fees, institutional investment could accelerate 6 network effect of established dApps and developer communities creates significant barriers to entry for 7 2030: Long-Term Vision and $10k Potential Reaching $10,000 per ETH by 2030 represents approximately a 3x increase from current 8 ETH 2030 target becomes increasingly plausible when considering: Global adoption of blockchain technology across industries Ethereum’s first-mover advantage in smart contracts Potential for mass adoption of Web3 applications Macroeconomic factors favoring digital assets Can Ethereum Reach $10k?

Critical Factors to Watch The path to Ethereum reaching $10k depends on several converging 9 activity must continue growing, with daily transactions and active addresses showing sustained 10 development roadmap must deliver on promised scalability improvements without compromising 11 importantly, Ethereum must maintain its developer mindshare against growing competition from alternative Layer 1 12 and Challenges in Ethereum Price Prediction While optimistic about Ethereum’s long-term prospects, investors should remain aware of potential 13 uncertainty remains a significant concern, particularly regarding how different jurisdictions will treat staking rewards and DeFi 14 risks include potential security vulnerabilities in smart contracts and the possibility of more scalable competitors 15 Insights for Ethereum Investors Successful Ethereum investing requires both technical understanding and strategic 16 dollar-cost averaging to mitigate timing risk, and maintain a long-term perspective through market 17 informed about protocol upgrades and ecosystem developments, as these fundamentally impact Ethereum’s value 18 maintain proper risk management and never invest more than you can afford to 19 Asked Questions What is the most realistic Ethereum price prediction for 2025?

Most analysts project Ethereum between $4,000 and $8,000 by 2025, depending on adoption rates and macroeconomic 20 does Ethereum 2.0 affect price predictions? The transition to proof-of-stake reduces selling pressure from miners and introduces staking rewards, creating fundamentally different supply 21 companies are building on Ethereum? Major organizations including ConsenSys , Compound Labs , and Uniswap Labs have built significant products on 22 are key figures in Ethereum’s development? Vitalik Buterin remains the most prominent figure, along with core developers like Vlad Zamfir and researchers at the Ethereum 23 regulatory changes impact Ethereum’s price?

Yes, regulatory clarity or restrictions in major markets like the US, EU, and China significantly influence institutional adoption and price momentum. Ethereum’s journey toward $10,000 represents more than just price appreciation—it symbolizes the maturation of decentralized technology and its potential to transform global 24 the path will likely include volatility and unexpected challenges, the fundamental value proposition of a programmable, decentralized world computer continues to strengthen with each protocol upgrade and ecosystem 25 learn more about the latest cryptocurrency markets trends, explore our article on key developments shaping Ethereum institutional 26 post Ethereum Price Prediction 2025-2030: Will ETH Reach $10k?

first appeared on BitcoinWorld .

Story Tags

Latest news and analysis from Bitcoin World