CryptoQuant’s research head has pointed out how demand to absorb Bitcoin at higher prices has been low recently, potentially explaining the asset’s 0 Apparent Demand Metric Has Turned Red Recently In a new post on X, Julio Moreno, head of research at on-chain analytics firm CryptoQuant, has looked at recent BTC market dynamics from a different angle. “Instead of looking at Bitcoin long-term holder distribution/spending, I like to look at the other side of the trade,” noted 1 Reading: Crypto Analyst Maps Out Dream Ethereum Scenario To $8,000 Long-term holders here refer to the BTC investors who have been holding onto their coins for a period longer than 155 2 cohort is considered to include the high-conviction “HODLers” of the market, so distribution from them is often something on-chain analysts watch out 3 CryptoQuant community analyst Maartunn has highlighted in a separate X post, Bitcoin long-term holders have participated in a significant amount of selling during the past 4 isn’t the signal Moreno focuses on, however.

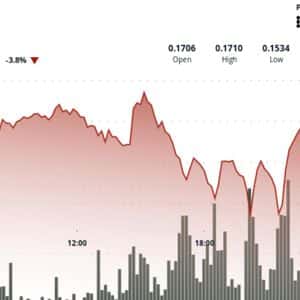

Instead, the CryptoQuant head checks for whether there is enough demand coming in to absorb the supply that the long-term holders are selling at higher 5 indicator that can be useful for tracking this is the Apparent Demand, which compares the difference between BTC’s production and changes in its long-term inventory. “Production” is the amount that miners are issuing on the network every day, while the “inventory” is the supply that has been inactive for over a year. Now, here is the chart shared by Moreno that shows the trend in the 30-day and 1-year versions of the Bitcoin Apparent Demand over the last few years: As displayed in the above graph, the Bitcoin Apparent Demand has been red on the 30-day during the last few weeks, implying a negative short-term demand for the cryptocurrency.

“Is there enough demand to absorb the supply at higher prices?” asked the analyst. “Since a few weeks ago the answer is no, and that is why we see prices declining.” The story is a bit different when it comes to the 1-year Apparent Demand, which has actually seen some growth recently, but the pace of its rise has been slow, and its value is still below the 90-day simple moving average (SMA). Related Reading: Bitcoin At Key Retest: Bounce Or $98,000 Next? The last time Bitcoin saw an extended phase of negative 30-day Apparent Demand was during the bearish phase in the first half of the 6 now remains to be seen whether something similar will follow this time as well, or if demand will bounce 7 Price At the time of writing, Bitcoin is floating around $103,900, down 9% over the last seven 8 image from Dall-E, CryptoQuant.

com, chart from 9

Story Tags

Latest news and analysis from NewsBTC