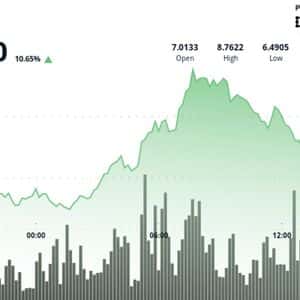

Bitcoin is flashing red signals that have spread right into the equity markets territory once again, a pattern that has led Wall Street to brace itself for a more “mummed” end of the year 0 largest coin by market cap’s trading behavior has been mostly similar to the Nasdaq 100’s trajectory, providing profound signals for investor risk 1 the cryptocurrency trades above its 55-day moving average, the Nasdaq’s returns are more 2 entered a technical bear market on Monday and has now dropped below $100,000 for the first time since 3 digital asset has crumbled 20% from its record high of $126,200 set on October 6, well below that 55-day MA, dooming equities to fresh signs of 4 crunch takes down crypto and stock market greed Cryptopolitan reported earlier this week that a liquidity squeeze pushed the US Treasury to rebuild its cash balance and cover a $500 billion decline in bank reserves clouding the central bank since 5 tightening has drained liquidity across financial markets, leaving both equities and cryptocurrencies bleeding 6 stock futures ticked slightly higher on Friday, but only after a punishing session that left major indices ticking 7 Thursday’s market session close , the Dow Jones Industrial Average dropped 398.70 points, or 0.84%, to close at 46,912.30.

The S&P 500 slid 1.12% to 6,720.32, while the Nasdaq Composite tumbled 1.9% to finish at 23,053.99. The Nasdaq 100, which includes the market’s heavily weighted tech stocks, is down more than 2% since last Friday and on track for its worst week since early 8 and AI stocks , which have powered much of this year’s equity rally, moved unevenly through Thursday’s session, adding to Wall Street’s 9 shed nearly 4% despite posting stronger-than-expected quarterly results, warning that it could lose future business with 10 dropped by 7%, while Palantir and Oracle fell about 7% and 3%, 11 of Nvidia and Meta Platforms, two of the “Magnificent Seven” also shed 12 analysts believe Bitcoin’s move below the $100,000 level has compounded risk aversion among equity investors, particularly those tracking correlations between digital assets and tech stocks.

“The sentiment index has fallen to 21, the lowest level since April 9, indicating extreme fear,” said Alex Kuptsikevich, chief market analyst at FXPro. “Last month, entering this territory triggered a rebound, but the market has already fallen below those levels.” Weeks of persistent selling have shaved Bitcoin’s year-to-date gain down to just 8%, trailing far behind the S&P 500’s 15% uptick over the same 13 room for a deeper fall, dark times ahead According to crypto market analyst CryptOpus, Bitcoin’s short-term technical setup has trapped the coin in a narrowing range between $102,000 and $104,000, with both resistance and support levels being tested. #BTC /USDT ANALYSIS #Bitcoin has broken down from the rising wedge #pattern with significant volume.

Currently, it is #trading above the 50MA, which is acting as a key support 14 here, we can expect a potential rebound. However, a breakdown below the 50MA would signal… 15 — CryptOpus (@ImCryptOpus) November 7, 2025 The cryptocurrency was rejected from its 100-day moving average near $110,000 earlier this week and subsequently retested the $101,000 support, completing a full liquidity sweep of its prior range 16 Wednesday, BTC briefly stabilized at just over $104,000 before slipping to $100,500. By Thursday, it had surrendered the six-digit territory entirely, dipping to $99,700 on 17 king coin is confined between a $100,000–$102,000 demand zone and a $114,000 resistance cluster, with both the 100-day and 200-day moving averages as overhead 18 labor market data sends traders into tears According to Challenger, Gray & Christmas, US companies announced more than 153,000 job cuts in October, nearly triple the level in September and 175% higher than a year 19 is the highest October totals recorded in 22 years and puts 2025 on pace to be the worst year for layoffs since 20 health of the US economy is not in a good place, evident in the ongoing government shutdown that has now stretched beyond a month and delayed economic reports.

“We’re starting to get dribs and drabs of economic data that’s not government-related, and it’s not super 21 that stuff is just setting up for some market weakness,” said market strategist 22 your strategy with mentorship + daily ideas - 30 days free access to our trading program

Story Tags

Latest news and analysis from Cryptopolitan