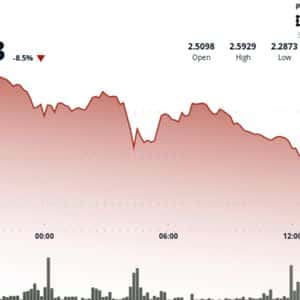

The Federal Reserve’s widely expected 0.25% rate cut on Wednesday triggered a wave of volatility across both traditional and crypto markets. Powell’s cautious words spooked crypto markets as Bitcoin briefly dipped below $108,000 in a classic “buy the rumor, sell the news” 0 historical patterns point to rebounds after such crowd 1 Turns Cautious Santiment, in its latest update, stated that Bitcoin’s decline following Jerome Powell’s hawkish tone reflected an overextension of optimism that had built up ahead of the 2 had priced in a dovish message and further easing through year-end, but Powell’s warning that another cut in December is “not guaranteed” flipped sentiment 3 plunged below $110,000 as traders who had positioned for a dovish outcome began to unwind their longs.

On-chain data showed a notable increase in exchange inflows and a cooling in funding rates, which meant that leveraged traders were caught off guard by the Fed’s 4 sentiment also flipped sharply negative, and discussions around “rate cut,” “Powell,” and “Fed” dominated crypto-related chatter. Historically, Santiment observed, these surges in crowd attention and fear have often coincided with short-term price bottoms, suggesting a possible setup for a rebound once panic 5 firm reported that Bitcoin’s correlation with equities weakened immediately after Powell’s comments, while its behavior aligned more closely with 6 experts, however, believe this to be a temporary defensive turn among investors seeking stability amid policy 7 the broader crypto market, altcoins followed Bitcoin’s move as total market capitalization declined modestly as traders reassessed expectations for liquidity expansion.

However, the crypto analytics firm pointed out that funding rates across major exchanges have now normalized, meaning excessive leverage has been flushed 8 is expected to set the stage for more organic 9 firm also detected mild accumulation behavior among large holders, as some whales took advantage of the post-FOMC 10 of now, BTC’s price structure remains intact above key support levels, but sentiment remains cautious. What’s Next For Bitcoin? Santiment said that if short positions begin to build in the next trading sessions, it could set up conditions for a short squeeze, potentially pushing Bitcoin back toward the $115,000 11 the near term, volatility is expected to remain high as traders digest the Fed’s 12 a statement to CryptoPotato , analysts at crypto trading platform Bitunix said that Bitcoin’s near-term outlook remains 13 downside risks remain if support fails, the presence of strong liquidity clusters and ongoing rebalancing may help stabilize price action.

“Bitcoin’s liquidation heatmap shows key support between $109,600-$108,000 – a breakdown below could trigger cascading liquidations – while resistance lies near $112,300 and $116,000. With liquidity being reallocated and the dollar regaining strength, the crypto market may enter a phase of choppy 14 the short term, investors should stay alert to safe-haven flows driven by macro-policy uncertainty, as markets transition into a new stage of ‘structural repricing.'”

Story Tags

Latest news and analysis from Crypto Potato