Warren Buffett’s Berkshire Hathaway has hired banks to explore a possible sale of yen-denominated 0 proposed sale would bring it back to the yen market for the second time this 1 the issuance proceeds, Berkshire Hathaway’s yen bond sale would follow its earlier April 2025 issuance of six yen-denominated bonds totalling $627 2 reported by Cryptopolitan, it was its smallest yen bond deal to date, with maturities ranging from 3 to 30 years. Buffett’s Japanese trading houses outperform peers Berkshire has made some of the biggest deals in the yen markets in the 3 company has double A grades and can get more spread than local companies with similar credit 4 a letter to owners this year, Buffett said that the company started buying shares in Itochu Corp., Marubeni Corp., Mitsubishi Corp., Mitsui & Co., and Sumitomo 5 6 Namioka, chief strategist at T&D Asset Management Co., said that the possible offering shows that Japanese trading houses are still cheap from a global perspective and are considered 7 is good for the 8 Namioka said , “Given that Berkshire is currently holding a considerable amount of cash, the fact that it is issuing yen-denominated bonds suggests that it sees investment opportunities in Japan — likely directing funds toward trading companies.” Hiroshi Namioka added that while Berkshire agreed to keep its ownership of each company’s shares below 10%, as the company got closer to that limit, the five companies agreed to loosen the ceiling a bit.

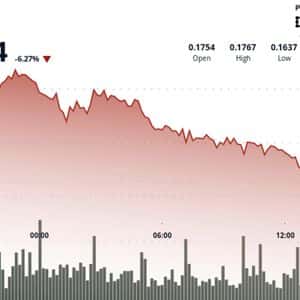

“Over time, you will likely see Berkshire’s ownership of all five increase somewhat,” Buffett wrote this year. Buffett’s Japanese trading houses’ performance.) in bonds since its start in 9 makes it the biggest foreign seller of yen notes during that 10 to reports, yen loans from foreigners are at their lowest level in four years, at about ¥1.8 11 interest rates are rising, and the Bank of Japan is likely to further tighten monetary 12 has made Japanese buyers cautious about purchasing corporate bonds this 13 Haruyasu Kato, a fund manager at Asset Management One Co., put it, “the biggest focal point will be the total issuance amount.” He also said, “it will serve as a litmus test for gauging investor sentiment and available funds across the yen credit market as a whole.” As a result, market watchers speculate that it may be considering additional investments in 14 week, there were more bond sales in the local yen market from companies outside of 15 example, Renault SA and Slovenia are about to price 16 investor’s stakes in Japan’s five biggest trading companies were first made public in August 17 then, the shares of those companies have more than tripled in 18 smartest crypto minds already read our 19 in?

Join them .

Story Tags

Latest news and analysis from Cryptopolitan