American credit rating agency S&P Global has given Strategy (formerly MicroStrategy), the largest institutional Bitcoin (BTC) investor, a B- rating, meaning junk. Accordingly, S&P Global Ratings issued a B- junk credit rating to Strategy, indicating that the company is in the “high risk” 0 agency cited the company's heavy reliance on Bitcoin, its weak capital structure relative to its risk profile, and its fragile US dollar liquidity as justification for its rating. S&P Global noted that Strategy's business model (buying and holding Bitcoin as a reserve asset financed through equity and debt) provides investors with indirect exposure to Bitcoin without actually holding it.

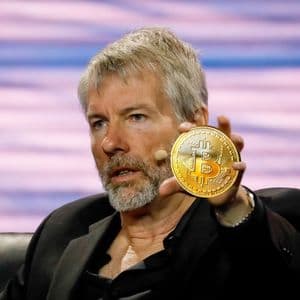

However, S&P added that the Strategy's Bitcoin concentration continues to dominate its credit profile and introduces risks associated with regulatory actions and market volatility. S&P Global also said it is unlikely to upgrade Stategy's rating in the next 12 1 added that it could downgrade the rating further if Bitcoin prices fall sharply or the company's access to capital markets 2 S&P gave Global Strategy a rather negative rating, the company's founder, Michael Saylor, pointed out that Strategy was the first Bitcoin treasury company to receive a rating from a major credit rating 3 this point, the cryptocurrency market is more concerned about Strategy's rating from such a major credit agency than the junk rating it received, calling it a “victory.” Economists believe that for a company in the US to receive a rating from a major rating agency, or even to even reach their analysts' desk, is considered a significant 4 also noted that many large funds and companies prefer to invest in companies with rated 5 to economists, despite Strategy receiving a junk credit rating from S&P Global Ratings, the rating has placed it in the investment-grade category.

S&P Global Ratings previously gave the same B- rating to decentralized stablecoin issuer Sky Protocol (formerly MakerDAO). *This is not investment 6 Reading: US Giant S&P Global Gives Bitcoin Bull Startegy a Junk Rating! Is It Actually a Victory?

Story Tags

Latest news and analysis from BitcoinSistemi