0 capital goods orders rose by 1.1% in July, according to Commerce Department data released 1 jump followed a revised 0.6% drop in June, pointing to businesses finally moving forward with equipment investments after months of waiting on the 2 increase came from orders that excluded aircraft and military gear, which is basically the real stuff companies actually plan to 3 look at this number as a way to track real business 4 goods orders, including long-life items like planes and tanks, dropped 2.8% in July. A big part of that decline came from 5 company saw fewer plane orders last month compared to 6 increase shipments as investment gains speed Shipments of non-defense capital goods, including aircraft jumped 3.3%.

These are the numbers that feed directly into GDP 7 can be canceled, but shipments actually happened. That’s what gets counted in economic growth reports. Meanwhile, core capital goods shipments, which leave out aircraft and military equipment, rose 0.7%. That figure was revised higher for June 8 like this number more because it’s less messy and not distorted by huge one-off plane or tank orders that may not ship for 9 of this uptick in activity ties back to Q1 when Boeing’s orders 10 reason companies are suddenly spending again is AI.

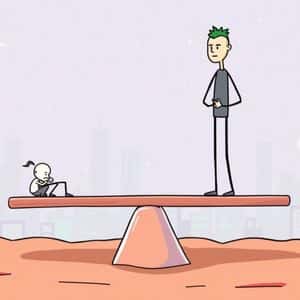

A bunch of firms ramped up equipment purchases to support artificial intelligence 11 investments are aimed at cutting costs and dealing with expensive tariffs and import 12 data showed orders for computers, machinery, electrical gear, metals, and even motor vehicles all went up in 13 were cautious for most of the year, unsure about where demand was heading or what tariffs might get slapped on 14 July looked like the beginning of a turnaround, at least for 15 with this rise, most analysts think business investment will stay weak through the rest of the 16 expect momentum to pick up in 2026, thanks to new tax benefits from Trump’s One Big Beautiful 17 bill includes incentives for companies that invest in new equipment and 18 the flip side, while capital spending improved, 19 confidence slid again in 20 Conference Board said its consumer sentiment index dropped to 97.4, down from a previously revised 108.7 in 21 are more nervous about jobs and 22 expectations index, which looks at where consumers think things are heading over the next six months, also 23 did the present conditions gauge, which hit its lowest reading since 24 Bloomberg survey had expected a sentiment score of 96.5, so the drop was sharper than some economists had 25 aren’t convinced the job market will hold steady, and they’re still feeling the sting from inflation and higher costs, even as businesses are out there upgrading their gear and pouring money into AI 26 you're reading this, you’re already 27 there with our newsletter .

Story Tags

Latest news and analysis from Cryptopolitan