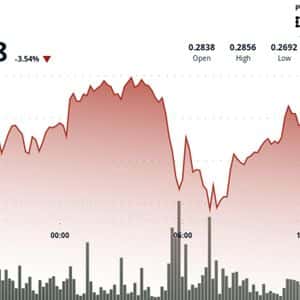

A sharp wave of liquidations rattled the crypto market over the past 24 hours, erasing more than $1.13 billion in leveraged long positions—with $303 million in Ethereum (ETH) 0 selloff underscores the growing fragility in a market stretched by leverage, macro uncertainty, and shifting institutional 1 traders grapple with losses, Outset PR , founded by crypto communications expert Mike Ermolaev, demonstrates how strategic, data-driven storytelling can help crypto projects build resilience and visibility even in turbulent markets. Over-Leveraged Traders Face Margin Calls Ethereum’s drop below $3,700 triggered a cascade of automated liquidations, forcing over-leveraged traders to close positions en 2 move reflects a chain reaction typical of high-volatility markets: as prices dip below key support, margin calls and stop-loss orders amplify selling 3 forced liquidation cycle rapidly drains liquidity and accelerates price declines, leaving both retail and institutional traders scrambling for 4 Faces a Triple Threat Ethereum’s correction illustrates a triple threat scenario: Forced unwinds of leveraged longs, Macro headwinds undermining risk sentiment, and Lingering DeFi security concerns dampening investor 5 critical question now is whether ETH can hold the $3,575–$3,600 support zone—the level corresponding to July’s swing low.

A decisive close below that area could expose ETH to a deeper pullback toward $3,460, the 78.6% Fibonacci retracement 6 bulls, maintaining this zone is vital. A rebound from here could signal a healthy reset in leverage, paving the way for stabilization and gradual 7 if macro conditions worsen or Bitcoin extends its drawdown, Ethereum could struggle to reclaim lost 8 PR Crafts Communications Like a Workshop, Powered by Data Outset PR operates more like a workshop than a traditional agency—each campaign is built with market fit and timing in 9 of relying on random placements or templated packages, the team crafts messaging that aligns precisely with market sentiment, ensuring a client’s story lands when attention is 10 outlets are selected based on metrics such as discoverability, domain authority, conversion potential, and viral 11 pitch is tuned to match a platform’s editorial voice and audience demographics, and the rollout is timed to unfold organically—much like how successful traders map entry points in volatile 12 PR’s boutique approach is backed by daily analytics and trend monitoring, allowing campaigns to follow market momentum rather than chase 13 result is a verifiable, data-led impact that translates communications into measurable 14 agency’s record speaks for itself: Step App: 138% rise in FITFI token value during the campaign.

Choise. ai: CHO token surged 28.5x amid coverage of a business upgrade. ChangeNOW: Customer base grew 40% through multi-layered PR. StealthEX: 26 tier-1 media features, 3.62 billion estimated total 15 through tier-1 pitching, editorial-focused content, or targeted media outreach for early-stage projects, Outset PR ensures clients gain traction that lasts beyond market 16 founders who want communications grounded in performance data and market logic, this is what PR should feel like.

Outlook: Near-Term Pain, Long-Term Opportunity While the current liquidation storm highlights the risks of over-leveraged positioning, it also sets the stage for potential accumulation once excess leverage is flushed out. Historically, such deleveraging phases have preceded renewed uptrends, especially when underlying fundamentals—such as network activity and institutional inflows—remain 17 the near term, traders will watch for Ethereum’s ability to defend $3,575–$3,600, the behavior of futures open interest, and ETF flow stability as key indicators of market 18 macro headwinds ease and liquidity returns, Ethereum may remain range-bound—but for long-term investors, these volatile corrections often create strategic entry points rather than lasting breakdowns.

Disclaimer: This article is provided for informational purposes 19 is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Story Tags

Latest news and analysis from Crypto Daily