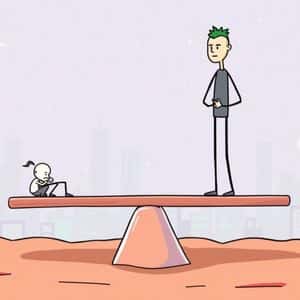

BitcoinWorld Institutional Crypto Options: Historic Trade by Goldman Sachs & DBS Forges New Path The financial world is buzzing with a landmark development: global investment giant Goldman Sachs and Southeast Asia’s largest bank, DBS, have successfully completed their first-ever over-the-counter (OTC) institutional crypto options 0 isn’t just another transaction; it’s a significant stride in bridging the gap between traditional finance and the rapidly evolving digital asset 1 collaboration marks a pivotal moment, signaling growing institutional confidence and 2 Does This Institutional Crypto Options Trade Involve? This groundbreaking transaction focused on cash-settled Bitcoin and Ethereum 3 are financial contracts giving the holder the right, but not the obligation, to buy or sell an underlying asset at a predetermined price.

Cash-Settled: Settlement is in fiat currency, not physical 4 allows for exposure without direct custody. Hedging: Both firms used these options to manage exposure to crypto price volatility, a common risk mitigation strategy in traditional 5 (Over-the-Counter): The trade was executed directly between the two parties, allowing for customized terms and privacy, unlike public exchange 6 use of familiar financial instruments for institutional crypto options is 7 shows how established banks integrate digital assets into existing frameworks, making crypto more accessible for a broader institutional 8 is This Institutional Crypto Options Deal a Game Changer?

This collaboration isn’t merely a transactional milestone; it represents a profound shift in how major financial institutions view and interact with the crypto space. Here’s why it’s so significant: Mainstream Validation: Engagement from Goldman Sachs and DBS signals legitimacy and maturity for the digital asset 9 Management Innovation: Options for hedging demonstrate sophisticated risk management applied to crypto, essential for attracting more institutional 10 TradFi and DeFi: Adapting traditional instruments for digital assets fosters a more interconnected global financial 11 Progress: Such transactions often pave the way for clearer regulatory frameworks, as regulators observe regulated entities in action.

Asia’s Growing Influence: DBS’s involvement highlights Asia’s increasing importance, suggesting its market frameworks will align with global institutional 12 move by two major banks suggests that the era of institutional adoption of cryptocurrencies is already here, moving beyond speculation to strategic financial integration. What’s Next for Institutional Crypto Options and Digital Assets? The completion of this inter-bank trade opens doors to a future where digital assets are seamlessly integrated into mainstream financial 13 can anticipate several key trends: Increased Institutional Participation: More banks, hedge funds, and asset managers will likely explore similar hedging mechanisms and direct crypto 14 of New Products: This success could spur the creation of diverse crypto-linked financial products, including structured notes and swaps, tailored for institutional 15 Market Liquidity: Greater institutional involvement typically leads to deeper liquidity, reducing volatility and making the market more 16 Regulatory Landscape: Increased participation by regulated entities will likely accelerate comprehensive regulations for digital assets, including specific guidelines for institutional crypto 17 like regulatory uncertainty, technological complexities, and market volatility remain, but the momentum is 18 are finding ways to navigate these complexities, pushing the market forward.

Conclusion: The landmark institutional crypto options trade between Goldman Sachs and DBS marks a crucial turning point for the digital asset landscape. It’s a clear indicator that major financial players are not just observing but actively participating in shaping the future of crypto, bringing sophisticated financial tools and risk management practices to this nascent 19 collaboration underscores a growing confidence in digital assets and paves the way for further integration of cryptocurrencies into the global financial 20 future of finance looks increasingly digital, and this partnership is a powerful testament to that 21 Asked Questions About Institutional Crypto Options Q: What are cash-settled Bitcoin/Ethereum options?

A: These are derivatives where profit/loss is settled in cash, not physical 22 allow institutions to speculate on price movements or hedge exposure without holding the actual asset. Q: Why did Goldman Sachs and DBS use options for hedging crypto? A: Options help institutions limit potential losses from crypto price volatility, a key risk management tool that allows them to manage risk effectively. Q: How does an OTC trade differ from an exchange trade?

A: OTC trades are direct between two parties, offering flexibility in terms and pricing, especially for large institutional transactions, unlike public exchange trades. Q: What does this trade mean for crypto adoption? A: It signifies a major step in mainstream institutional adoption, showing regulated banks can securely engage with digital assets, encouraging broader market entry and 23 landmark development is reshaping the financial 24 are your thoughts on the growing role of traditional banks in the crypto market? Share this article on your social media channels and join the conversation!

Let’s discuss how institutional crypto options are paving the way for the future of 25 learn more about the latest crypto market trends, explore our article on key developments shaping Bitcoin and Ethereum institutional 26 post Institutional Crypto Options: Historic Trade by Goldman Sachs & DBS Forges New Path first appeared on BitcoinWorld .

Story Tags

Latest news and analysis from Bitcoin World