It’s been a thrilling year in crypto, one filled with more highs than lows and no shortage of volatility. ETH, having languished far behind BTC for the first half of the year, is now on the move and projected to finish the year higher after shrugging off the late October pullback that’s tempered the crypto market. meanwhile, the search for sustainable onchain yield is gathering pace, with RWAs increasingly featuring in the 0 ability to earn yield from real-world assets – while using these same assets as collateral to mint stablecoins – has been one of this year’s onchain success 1 Q4 2025 hits high gear, another entrant to the RWA sector, ConstructKoin (CTK), has been capturing mindshare as its presale paves the way for real-estate tokenization on an industrial 2 two months left in this year’s market cycle, investors are chasing assets that have yet to pump – while the shrewdest among them are hedging their bets by allocating to a combination of crypto majors and emerging assets such as CTK that support portfolio 3 does this thesis hold weight?

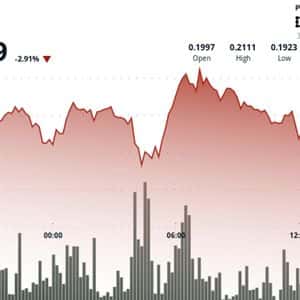

Let’s examine the 4 Consolidates as the Market Prepares to Move Up ETH is trading around $3,850 on October 30, 2025, having dipped slightly amidst a volatile week for crypto 5 institutional inflows, however, have ensured there is significant support at this price level as ETFs continue acquiring vast amounts of Ethereum’s native 6 it’s easy to find hyper-bullish price predictions for ETH on the web, one of the more rational, CoinCodex , projects ETH reaching $4,350 over the coming 7 it can reclaim that threshold and find a floor there, ETH looks odds-on to finish the year close to an all-time high and enter 2026 with fresh 8 have been kept busy buying and selling ETH this month in response to investor demand, resulting in huge in- and outflows that have broadly balanced for the 9 had all year to stock up on BTC, however, there is clear evidence that ETH is now receiving the same treatment, leaving it on course to grind higher as 2025 closes 10 Yield Stacks Up as ConstructKoin (CTK) Presale Comes Into Play Moving away from crypto majors and into the RWA sector that’s been ticking over all year, and there are clear signs that investors are seeking new yield 11 of this year’s greatest success stories has been the integration of real-world assets with DeFi, allowing investors to earn yield from RWAs such as T-bills and 12 the yields available from synthetic stablecoin leaders Ethena and Falcon Finance has been the main story in this sector of late, there’s another player entering the game with the promise of even greater APYs for token 13 (CTK) is in the ReFi business – that’s real estate finance – and is committed to launching its own stablecoin once its market cap reaches $100M.

CTK holders who stake the native token will be eligible for up to 12% in yield, disbursed in USDT, which is derived from the real estate projects it 14 already secured $15M of assets onchain, it’s well on its way to fulfilling this 15 its loan book grows in size, so will the interest available to investors. It’s another example of how real-world assets, including bricks and mortar, are being tokenized and in the process transformed into yield-bearing assets that allow astute investors to earn returns regardless of broader market 16 ConstructKoin’s development continues apace, 2025 looks poised to finish on a high note, with opportunities for ETH traders and RWA investors willing to fill their bags and wait for the market to do the rest.

Disclaimer: This is a sponsored article and is for informational purposes 17 does not reflect the views of Crypto Daily, nor is it intended to be used as legal, tax, investment, or financial advice.

Story Tags

Latest news and analysis from Crypto Daily