The crypto market is entering a new phase of 0 investors, once skeptical of digital assets, are now moving in with immense capital , sophisticated tools, and clear 1 shift is changing not only how prices move but also how ownership and control are 2 XRP holders, the development presents both opportunities and 3 and crypto analyst CryptoSensei recently issued a stern warning to investors on his X handle, urging them to rethink how and where they store their 4 cautionary message highlights an overlooked reality: that while institutions bring legitimacy and liquidity, they also introduce complex risks that can reshape market 5 Shift in Crypto Markets Institutional players are rapidly becoming dominant in the cryptocurrency 6 presence brings scale, structure, and professional market-making.

Yet, it also brings strategies capable of overwhelming retail 7 entities have long histories of managing and manipulating traditional 8 crypto, their influence can be even more pronounced due to lower liquidity and fewer regulatory safeguards. #XRP HOLDERS!!! THEY ARE COMING FOR YOUR CRYPTO!!! 9 — CryptoSensei (@Crypt0Senseii) November 3, 2025 CryptoSensei’s analysis draws parallels between today’s market and earlier financial eras where large institutions dictated price direction and trading 10 more funds, banks, and asset managers gain exposure to XRP and other cryptocurrencies, the potential for sudden market swings grows 11 participants must therefore understand that institutional participation is not purely a positive 12 and the Question of Ownership At the heart of CryptoSensei’s warning lies a fundamental question — what does it truly mean to “own” your crypto?

Many investors believe that having XRP exposure through exchange-traded funds or custodial platforms equals ownership. However, the reality is more 13 XRP is held in a self-custodied wallet, the holder controls the private keys, hence, the asset 14 contrast, ownership through custodial intermediaries, such as ETFs or managed funds, is 15 custodian retains legal control of the asset, and the investor holds a financial claim rather than the underlying 16 the custodian faces operational, legal, or financial trouble, investors could lose access to their 17 are on X, follow us to connect with us :- @TimesTabloid1 — TimesTabloid (@TimesTabloid1) June 15, 2025 This distinction mirrors lessons from traditional finance, where brokerage clients can suffer losses when institutions mismanage 18 the crypto space, the FTX collapse remains a vivid reminder that “not your keys, not your coins” is more than a slogan — it is a principle of 19 Manipulation and Liquidity Traps Institutions entering crypto markets can move prices with 20 can exploit thin order books, trigger liquidations, and profit from the volatility that 21 “surgical liquidity events,” as CryptoSensei describes them, often target overleveraged retail 22 dynamics were observed in past Bitcoin and XRP corrections , where large sell-offs occurred after institutional 23 regulation is improving, transparency remains limited, giving major players an advantage in timing, execution, and 24 ordinary XRP investors, this creates a landscape where caution and awareness are 25 Path Forward for XRP Holders CryptoSensei’s message is not one of fear but of 26 underscores the importance of self-custody, due diligence, and education in navigating a maturing 27 holders must know exactly where their assets are stored and who controls 28 institutions tighten their grip on liquidity and market structure, individual investors can still maintain independence through informed 29 ownership begins with self-custody, continued vigilance, and understanding that security in crypto is not granted — it is 30 a world where institutions are coming for your crypto, awareness is your first line of defense, and control is your greatest advantage.

Disclaimer: This content is meant to inform and should not be considered financial 31 views expressed in this article may include the author’s personal opinions and do not represent Times Tabloid’s 32 are advised to conduct thorough research before making any investment 33 action taken by the reader is strictly at their own 34 Tabloid is not responsible for any financial 35 us on Twitter , Facebook , Telegram , and Google News

Story Tags

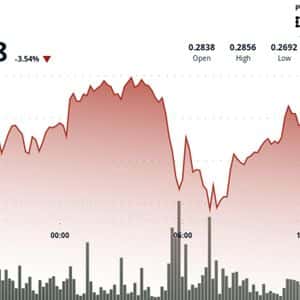

Latest news and analysis from TimesTabloid