The Bank of Japan kept its benchmark interest rate at 0.5% on Friday, ending a two-day meeting in Tokyo without any change in monetary 0 vote split was 7 to 2, and literally no one was surprised—all 50 economists polled by Bloomberg expected the 1 the real development wasn’t the 2 real story? For the first time ever, the central bank said it’s going to start dumping its exchange-traded 3 ETF stash, built up during Japan’s wild pandemic-era monetary easing campaign, is valued at around ¥37 trillion on the 4 in 2020, the BoJ became the largest single owner of Japanese stocks, but that buying spree ended last year. Meanwhile, Japan’s core inflation dropped to 2.7% in August, the lowest reading since November 5 was the third straight monthly decline, so its not the kind of trend that gets the BoJ in a hurry to hike 6 exit stalls BoJ as inflation dips and yen stays firm Friday’s decision came just days after Prime Minister Shigeru Ishiba announced his resignation, throwing the ruling party into a sudden race to replace 7 political shakeup added yet another layer of uncertainty to an already murky economic outlook.

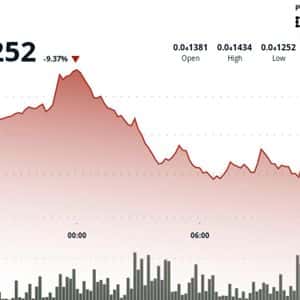

It’s been less than a year since the last leadership vote, and once again, Japan is without a clear political 8 was one reason the BoJ didn’t move on rates; it’s waiting to see who takes over and where they’ll steer policy. There’s also the 9 that the BoJ is 10 though Japan recently wrapped up a trade deal with the United States, central bank officials are still trying to figure out how the tariffs will play out, both domestically and abroad. That’s another reason they’re staying on the 11 didn’t love the 12 surging to a new record earlier in the day, the Nikkei 225 lost 0.59% by close, while the yen gained 0.36%, sitting at 147.45 per dollar as of press 13 Amemiya, investment director at Capital Group, told Bloomberg: “The Bank of Japan’s decision to hold rates steady underscores its cautious stance amid slowing inflation and global uncertainty – prioritizing stability over premature tightening.” He added : “By preserving policy optionality, the BoJ is signaling its readiness to respond to external volatility while continuing to assess the strength of Japan’s economic recovery.” He also said the current approach fits the early stage of a reflationary cycle, not a 14 yields climb, stocks mixed Not everyone stood 15 on Japan’s 2-year government bonds rose to 0.885%, their highest level since June 2008, according to 16 spike came even with the central bank holding steady.

Meanwhile, the Topix rose 0.84%, showing traders are still playing both sides of the 17 the region, we see Australia’s ASX/S&P 200 edged by 0.77%, South Korea’s Kospi and Kosdaq opening flat, and Hong Kong’s Hang Seng Index dropped by 0.4%, while China’s CSI 300 added a modest 0.13%, according to data from Yahoo 18 India, the Nifty 50 index dipped 0.55%, but Adani Enterprises surged over 4%. That spike followed news that India’s market regulator had absolved Gautam Adani and the Adani Group of key misconduct allegations from Hindenburg 19 fight’s not over, but at least for now, Adani is breathing 20 in the United States , the Federal Reserve’s signal that it’s leaning toward easing rates helped push markets 21 Thursday, the S&P 500 rose 0.48%, closing at 6,631.96.

The Nasdaq Composite jumped 0.94% to 22,470.73, while the Dow Jones Industrial Average added 124 points (or 0.27%) to finish at 46,142.42. All three indexes hit new all-time intraday highs on 22 came after a chaotic Wednesday session, triggered by the Fed’s rate 23 clearly liked what they heard, and smaller stocks especially got a 24 the middle of all this, Japan is still playing 25 crypto news deserves attention - KEY Difference Wire puts you on 250+ top sites

Story Tags

Latest news and analysis from Cryptopolitan