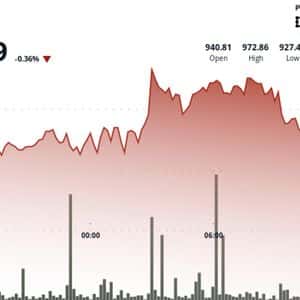

CryptoQuant warned in its Asia Morning Briefing that Bitcoin is now entering an extremely bearish phase. On-chain data shows that BTC is hovering around $101,000 as the Friday trading day began in Hong 1 the time of publication, Bitcoin is currently exchanging hands at $101,970, down 1.22% in the last 24 2 has also plummeted by nearly 7% in the past week and more than 16% in the last 30 3 drops below the 365-day moving average Bitcoin is currently trading below its 365-day 4 our latest report, published yesterday, about the implications if the price breaks below this level, specially in the current phase of bearish data. 0 — Julio Moreno (@jjcmoreno) November 6, 2025 CryptoQuant revealed in its latest weekly report that BTC dropped under the 365-day moving average of $102,000.

The analytics firm argued that the drop indicated the loss of a key technical and psychological support that previously defined the bottom of the bull cycle. CryptoQuant’s Bull Score Index has plummeted to zero for the first time in more than 3 5 signal was also last seen before the previous bear 6 analytics firm revealed that traders’ on-chain realized price bands indicate a potential downside move towards $72,000 if BTC fails to rally above $100,000 7 market data firm cited Metcalfe’s network valuation model, which also identified $91,000 as the next structural support 8 firm believes that failure to reclaim the 365-day moving average quickly could trigger a much larger 9 analytics report comes as Bitcoin has seen weeks of weakening fundamentals, including increased outflows, lower network activity, and a flattening of key on-chain valuation 10 analysts argued that BTC’s chart resembles a similar break in 2021 below the metric, which initiated the start of a prolonged 11 analyst Mike McGlone stated on Thursday that Bitcoin’s price may decline by nearly 50% if the current downward trend over the past month 12 also believes that if BTC hits $100,000 could accelerate a drop toward $56,000.

“My look at the chart shows how normal it’s been for the first-born crypto to revert to its 48-month moving average, now around $56,000, after similarly extended rallies as in 2025.” – Mike McGlone , Senior Commodity Analyst at Bloomberg 13 had dropped to $98,000 on November 4, which marks the current local 14 was also the first time since July that BTC plummeted below the $100,000 psychological 15 says BTC’s market remains cautious and oversold Bitcoin’s MVRV Ratio Signals Possible Bottom Formation Amid Fear and Liquidations “Historically, when MVRV falls to the 1.8–2.0 range, it often coincides with mid-term market bottoms or early recovery phases.” – By @xwinfinance 16 — 17 (@cryptoquant_com) November 6, 2025 Analysts at XWIN Research Japan stated on Thursday that BTC’s Market Value to Realized Value (MVRV) has declined to historical 18 firm confirmed that historical MVRV drops to the 1.8-2.0 range often coincides with mid-term market bottoms or early recovery phases.

Glassnode’s report earlier this week, titled ‘Defending $100K’, revealed that a normal correction within the ongoing cycle could be one key Bitcoin metric that indicates the recent 19 report also revealed that 71% of the market’s supply is still in profit, and unrealized losses are contained to just 3.1% of market 20 firm believes that the current reading of 3.1% suggests only moderate stress, unlike the 2022-2023 bear market, where losses reached extreme 21 added that it’s useful to assess the Relative Unrealized Loss, which measures the total unrealized losses in USD relative to market 22 firm maintained that the market can be classified as a mild bear phase, characterized by orderly revaluation rather than panic, as long as unrealized losses remain within the current 23 analytics firm argued that the data shows the market remains cautious, oversold, but not yet deeply 24 also acknowledged that long-term holders are selling and ETF outflows continue, but believes it’s just a mid-cycle correction rather than the start of a bear 25 have been debating Bitcoin’s short-term trajectory, with ARK Invest’s Cathie Wood reducing her long-term Bitcoin price projection by $300,000 on 26 warned that stablecoins are eroding the world’s largest digital asset’s role as a store of value in emerging 27 up to Bybit and start trading with $30,050 in welcome gifts

Story Tags

Latest news and analysis from Cryptopolitan