BitcoinWorld AI Funding Frenzy: Is the Artificial Intelligence Bubble Poised to Burst? The world of artificial intelligence is experiencing an unprecedented surge in investment, reminiscent of past tech 0 those deeply entrenched in the fast-paced cryptocurrency market, the rapid influx of capital into AI presents both exciting opportunities and familiar 1 we witnessing the next technological revolution, or is the AI bubble inflating to unsustainable levels? This question was at the heart of a compelling discussion at Bitcoin World Disrupt 2025, where the Equity podcast crew delved into the whirlwind of AI 2 the AI Bubble Inflating Too Fast?

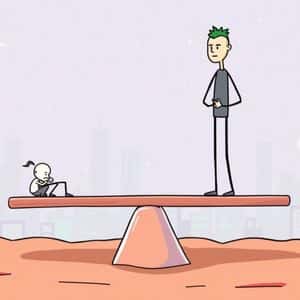

The sentiment is palpable: AI feels 3 sheer volume and speed of money flowing into artificial intelligence ventures are 4 are seeing valuations for promising AI companies triple in a matter of months, seed rounds hitting an astonishing $300 million, and commitments reaching the staggering figure of $100 5 many, this frenetic pace signals a potential peak bubble 6 Equity team, live from the Builders Stage, explored what this rapid acceleration means for the future of AI and its economic 7 dissected the wildest funding rounds of recent times, attempting to discern where this capital is truly headed and what sustainable business models, if any, are emerging from the 8 AI Funding Dynamics and Market Signals The current landscape of AI funding is characterized by a mix of genuine innovation and speculative 9 are pouring billions into companies developing foundational models, specialized applications, and the underlying 10 aggressive investment, while fueling rapid technological advancement, also raises questions about market efficiency and potential 11 observations from the Equity discussion include: Unprecedented Valuations: Companies with nascent products are achieving multi-billion-dollar valuations, often based on future potential rather than current 12 Seed Rounds: The concept of a ‘seed round’ has been redefined, with early-stage companies securing hundreds of millions, bypassing traditional funding 13 Commitments: Large tech giants and venture capital firms are making massive, long-term commitments, betting on AI to be the dominant technological paradigm of the next 14 rapid deployment of capital is reshaping the venture capital ecosystem, pushing the boundaries of traditional investment metrics and creating a highly competitive environment for promising AI 15 Rise of Data Centers AI Infrastructure One of the most significant and often overlooked beneficiaries of the AI boom is the infrastructure sector, particularly companies building and operating data centers AI 16 AI models grow in complexity and demand for computational power skyrockets, the need for robust, scalable data center infrastructure becomes 17 AI companies, recognizing this fundamental requirement, are placing substantial bets on owning or developing their own data 18 trend is not just limited to established tech giants; even smaller AI startups are factoring infrastructure into their long-term 19 demand for specialized hardware, like GPUs, and the energy required to run these facilities, are creating new investment opportunities and attracting unexpected players into the AI infrastructure 20 shift is redefining infrastructure investing, moving beyond traditional cloud services to highly optimized, AI-specific data 21 Equity team highlighted how this boom is reshaping the landscape of technological investment, making the ‘picks and shovels’ of the AI gold rush incredibly 22 the AI Startups Landscape: From Demos to Sustainable Models The proliferation of AI startups has brought forth a wave of innovation, but also a challenge: 23 startups gain initial traction through viral demos that showcase impressive AI capabilities.

However, the transition from a captivating demo to a viable, revenue-generating business model is proving to be a significant 24 Equity discussion touched upon the precarious position of companies whose entire business model hinges on a single, attention-grabbing 25 AI startups, the path to long-term success often involves: Beyond the Demo: Developing a robust product suite that extends beyond initial viral 26 Value Proposition: Identifying specific problems that AI can solve efficiently and profitably for target 27 Operations: Building an operational framework that can handle increasing user demand and data processing 28 Partnerships: Collaborating with established players to integrate AI solutions into existing 29 sustainability of these young companies will largely depend on their ability to move past the initial hype and build genuine, long-term value for their users and 30 the Scaling Race AI : Alternative Strategies Emerge While many in the AI industry are caught in an intense scaling race AI models to achieve greater computational power and larger datasets, some founders are deliberately charting a different 31 Equity podcast highlighted the intriguing perspective of Cohere’s former AI research lead, who is actively betting against the conventional wisdom of ‘bigger is always better.’ This contrarian view suggests that an excessive focus on scaling might lead to diminishing returns, unsustainable costs, and a homogenization of AI 32 strategies include: Efficiency and Optimization: Focusing on making smaller models more efficient and specialized for specific tasks.

Domain-Specific Expertise: Developing highly targeted AI solutions for niche industries rather than general-purpose 33 and Responsible AI: Prioritizing explainability, fairness, and safety in AI development, which may not always align with a pure scaling 34 AI: Exploring decentralized approaches that distribute computational power and data, potentially reducing reliance on massive centralized data 35 diverse approaches suggest a maturing industry where innovation is not solely defined by brute-force scaling but also by intelligent design and strategic differentiation. Conclusion: Navigating the AI Hype Cycle The current AI landscape is undoubtedly exciting, marked by rapid innovation and substantial investment.

However, the discussions at Bitcoin World Disrupt 2025, led by the insightful Equity team, underscore the importance of discerning sustainable growth from speculative 36 the promise of AI is immense, the challenges of identifying viable business models, managing infrastructure demands, and resisting the urge to simply ‘scale at all costs’ remain 37 investors and entrepreneurs alike, understanding these dynamics is paramount to navigating what could be a transformative, yet potentially volatile, period in artificial 38 Asked Questions (FAQs) Q1: What are the main indicators of a potential AI bubble ? A: Key indicators include rapidly escalating valuations for companies with limited revenue, mega seed rounds (e.

g., $300M seed rounds ), and massive commitments ( $100B commitments ) flying around in a short 39 the speed of money movement seems disconnected from traditional business fundamentals, it often signals a bubbly market. Q2: How is the current AI funding landscape different from previous tech booms? A: The current AI funding is unique due to the foundational nature of AI technology, impacting nearly every 40 previous booms, a significant portion of investment is going into core infrastructure like AI data centers and specialized hardware, suggesting a more fundamental shift in computing 41 global reach and rapid adoption are also unprecedented.

Q3: Why are data centers AI a critical focus for investment? A: As AI models become larger and more complex, they require immense computational 42 centers AI provide the necessary infrastructure – powerful GPUs, cooling systems, and high-bandwidth networks – to train and deploy these 43 are investing heavily to ensure they have the processing capabilities to remain competitive. Q4: What challenges do AI startups face in achieving sustainable growth? A: Many AI startups struggle to translate viral demos into sustainable business 44 include developing a clear revenue strategy beyond initial hype, managing the high costs of AI development and infrastructure, attracting top talent, and differentiating themselves in a crowded market.

Q5: Who are the key individuals and entities mentioned in the discussion? A: The discussion featured Theresa Loconsolo (Audio Producer), Kirsten Korosec (Transportation Editor & Co-host), Anthony Ha (Weekend Editor & Co-host), and Maxwell Zeff (Senior AI Reporter & Co-host) from Bitcoin World ‘s Equity podcast. A key perspective was also shared by Cohere ‘s former AI research lead, who is challenging the conventional scaling race 45 learn more about the latest AI market trends, explore our article on key developments shaping AI features and institutional 46 post AI Funding Frenzy: Is the Artificial Intelligence Bubble Poised to Burst? first appeared on BitcoinWorld .

Story Tags

Latest news and analysis from Bitcoin World