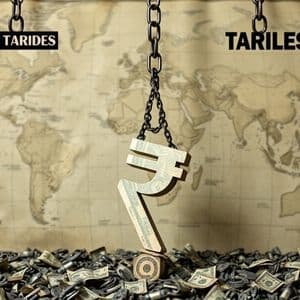

BitcoinWorld Indian Rupee Crisis: Unveiling the Devastating Impact of US Tariffs In the dynamic world of global finance, where digital assets like cryptocurrencies often grab headlines for their volatility, it is crucial to remember the foundational role of traditional fiat currencies. Lately, the Indian Rupee has found itself in a precarious position, teetering on the edge of a record low against the mighty US 0 isn’t just a number on a screen; it’s a stark indicator of underlying economic pressures, particularly the bite of steep US tariffs, which can have ripple effects even on the broader financial landscape, influencing investor sentiment across all asset classes, including 1 these macroeconomic shifts is vital for any investor navigating today’s interconnected 2 Rupee Crisis: A Deep Dive into Record Lows The Indian Rupee’s recent performance has been a cause for significant concern among policymakers, businesses, and citizens 3 currency has been steadily losing ground, inching closer to an all-time low against the US 4 trend is not isolated but a symptom of various domestic and international pressures converging.

A weaker rupee means that more rupees are required to buy one US Dollar, making imports more expensive and potentially fueling 5 a developing economy like India, heavily reliant on imported goods such as crude oil, this can have a cascading effect across all sectors. Historically, the Indian Rupee has faced periods of volatility, often influenced by global economic slowdowns, capital outflows, and geopolitical tensions. However, the current situation is compounded by specific trade-related issues that directly impact India’s economic 6 proximity to a record low is a clear warning sign, signaling a need for careful economic management and strategic policy interventions to stabilize the currency and protect the economy from further 7 the Force: How US Tariffs Bite India’s Economy At the heart of the Indian Rupee’s woes are the steep US Tariffs imposed on various Indian 8 tariffs, essentially taxes on imported goods, are designed to make foreign products more expensive in the US market, thereby encouraging domestic production.

However, for exporting nations like India, they translate into reduced competitiveness and lower demand for their 9 impact is multi-faceted: Reduced Export Earnings: Indian exporters find it harder to sell their products in the US, leading to a decline in export 10 directly impacts India’s trade balance and foreign exchange 11 Chain Disruptions: Tariffs can force companies to rethink their global supply chains, potentially diverting orders away from Indian 12 Uncertainty: Businesses planning to invest in export-oriented sectors in India might reconsider due to the unpredictable nature of trade policies and the risk of future tariffs. Sector-Specific Pain: Industries such as steel, aluminum, and certain agricultural products, which have been targets of US tariffs, face significant challenges, including reduced production and job 13 cumulative effect of these tariffs creates a challenging environment for India’s economy, putting downward pressure on the rupee as foreign currency inflows diminish and the trade deficit potentially widens.

It’s a classic example of how protectionist measures in one major economy can create significant economic headwinds for 14 Ripple Effect: Understanding Rupee Depreciation When the Rupee Depreciation occurs, its effects are felt far and wide, impacting everything from daily household budgets to the balance sheets of multinational corporations. It’s not just an abstract economic concept; it has tangible consequences for every Indian citizen and 15 Does a Weaker Rupee Mean for Your Wallet? A depreciating rupee has several direct implications for consumers: Higher Import Costs: Goods imported into India, such as electronics, luxury items, and most critically, crude oil, become more 16 India imports a significant portion of its energy needs, a weaker rupee directly translates to higher fuel prices, which in turn drives up transportation costs for all 17 Pressure: Increased import costs often lead to higher prices for a wide range of products, contributing to 18 erodes the purchasing power of consumers, making daily necessities more 19 on Foreign Travel and Education: For those planning to travel abroad or send their children for overseas education, a weaker rupee means spending more Indian currency to acquire the necessary foreign 20 Debt Burden: Indian companies or the government that have borrowed in foreign currencies find their repayment obligations increasing in rupee terms, adding stress to their financial 21 exporters might see a marginal benefit as their products become cheaper for foreign buyers, the overall negative impact of uncontrolled rupee depreciation often outweighs these advantages, especially in an economy heavily reliant on 22 the Storm: Global Trade Dynamics and India’s Position The current challenges faced by the Indian Rupee are not entirely isolated but are part of a larger narrative of shifting Global Trade 23 world has witnessed an increase in protectionist tendencies, with major economies engaging in trade disputes and imposing tariffs on each other’s 24 environment of uncertainty and trade friction creates a challenging backdrop for all trading nations, including 25 India Caught in a Wider Global Trade War?

India, as a significant player in global commerce, finds itself navigating complex trade 26 not directly involved in a full-blown trade war like some other nations, it is certainly impacted by the 27 US tariffs, for instance, are part of a broader strategy that has affected many countries, creating a domino effect where trade flows are redirected and global supply chains are re-evaluated. India’s response to these global trade dynamics involves a mix of diplomatic efforts and strategic policy 28 government might explore new trade agreements with other nations, diversify its export markets, and focus on boosting domestic manufacturing to reduce reliance on imports.

However, these are long-term strategies, and the immediate challenge remains managing the currency’s stability amidst external 29 the Headlines: The Wider Economic Impact on India The immediate concerns about the Indian Rupee and US Tariffs quickly translate into a broader Economic Impact on India’s growth trajectory and future 30 impact goes beyond just trade figures and currency valuations, touching various facets of the 31 Are the Long-Term Economic Impacts for India? The long-term economic consequences of persistent currency weakness and trade tensions can be significant: Economic Area Impact of Rupee Depreciation & Tariffs Foreign Direct Investment (FDI) Uncertainty can deter foreign investors, slowing down capital inflows essential for 32 Sustained import cost increases can lead to higher consumer prices, eroding purchasing 33 Finances Higher import bills for essential goods (like oil) can strain government budgets, affecting public 34 Market Export-oriented industries facing reduced demand might scale back operations, leading to job losses or slower job 35 Sentiment Rising prices and economic uncertainty can dampen consumer confidence, leading to reduced 36 these challenges requires a multi-pronged approach, including fiscal prudence, monetary policy adjustments, and proactive trade 37 the immediate outlook might seem challenging, India’s inherent economic strengths and potential for growth offer 38 focus will be on converting these challenges into opportunities for domestic innovation and 39 Insights and The Road Ahead For businesses and individuals alike, understanding the implications of a weakening Indian Rupee and the ongoing trade dynamics is 40 governments work on macroeconomic solutions, there are practical steps that can be considered: For Businesses: Explore hedging strategies to mitigate currency risks, diversify export markets beyond traditionally tariff-prone regions, and focus on value-added exports to improve 41 in domestic supply chains can also reduce reliance on potentially expensive 42 Individuals: Review personal budgets, especially for discretionary spending on imported 43 diversifying investment portfolios, potentially including assets that offer a hedge against inflation or currency depreciation, while always exercising caution and consulting financial 44 Policymakers: The Reserve Bank of India (RBI) plays a critical role in managing currency stability through monetary policy tools, such as interest rate adjustments and foreign exchange market 45 government must also focus on fiscal consolidation, boosting domestic manufacturing, and engaging in constructive trade negotiations to alleviate external 46 current scenario serves as a powerful reminder of the interconnectedness of the global economy.

A tariff imposed by one nation can create a ripple effect that destabilizes currencies and impacts economies thousands of miles away. India’s ability to navigate this complex landscape will depend on robust policy responses, resilient domestic markets, and strategic engagement on the global stage. Conclusion: A Critical Juncture for India’s Economy The Indian Rupee teetering near a record low, largely influenced by the biting impact of US Tariffs , signals a critical juncture for India’s 47 situation highlights the profound consequences of protectionist trade policies on global financial stability and the domestic well-being of 48 ensuing Rupee Depreciation reverberates through every aspect of life, from increased inflation to a higher cost of living and doing 49 the complexities of current Global Trade dynamics requires strategic foresight and adaptability from both the government and the private 50 broader Economic Impact underscores the urgent need for comprehensive policies that bolster domestic resilience, diversify trade relationships, and stabilize the 51 challenges are significant, they also present an opportunity for India to strengthen its economic foundations and foster greater self-reliance in a rapidly changing global 52 path ahead demands vigilance, innovation, and a collaborative approach to ensure sustained growth and 53 learn more about the latest Forex market trends, explore our article on key developments shaping the Indian Rupee and global currency 54 post Indian Rupee Crisis: Unveiling the Devastating Impact of US Tariffs first appeared on BitcoinWorld and is written by Editorial Team

Story Tags

Latest news and analysis from Bitcoin World