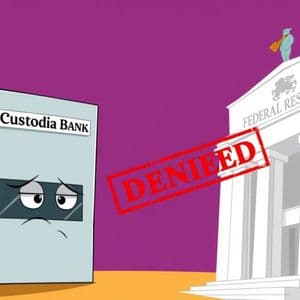

BitcoinWorld Crucial Setback: Custodia Bank Master Account Denied by Appeals Court In the evolving landscape of digital finance, direct access to the Federal Reserve’s payment systems is a game-changer for financial 0 access, typically granted through a “master account,” allows banks to operate efficiently and directly within the US financial system. Recently, a pivotal legal decision has cast a significant shadow over these aspirations for crypto-friendly banks, particularly concerning the Custodia Bank master 1 Happened with Custodia Bank’s Master Account Application? Custodia Bank, a Wyoming-based institution known for its focus on digital assets, found itself at the heart of a crucial legal 2 bank had sought a master account from the Federal Reserve, a move that would grant it direct access to the central bank’s services without relying on an intermediary 3 direct connection is vital for streamlining operations and reducing costs.

However, the Federal Reserve did not readily approve Custodia’s 4 that the central bank was unduly delaying or denying its request, Custodia Bank took legal 5 bank argued that the Federal Reserve was legally obligated to grant it a master account, paving the way for a significant court challenge that captured the attention of the entire crypto banking 6 Tenth Circuit’s Pivotal Ruling: A Setback for Custodia? The legal dispute culminated in a significant ruling by the 7 of Appeals for the Tenth 8 a 2-1 decision, the court sided with the Federal Reserve, concluding that the central bank is not legally required to grant Custodia Bank a master 9 ruling, as reported by Eleanor Terrett, represents a substantial development in the ongoing dialogue between traditional finance regulators and innovative crypto-focused 10 court’s decision underscores the discretionary power held by the Federal Reserve in determining access to its master account 11 Custodia Bank, this means the path to direct access remains 12 ruling specifically addressed the legal interpretation of whether the Federal Reserve must grant such accounts, rather than whether it 13 Takeaway: The Federal Reserve maintains significant authority in approving or denying master account 14 on Custodia: This decision directly affects Custodia’s operational model and its ability to integrate directly with the US financial 15 is a Federal Reserve Master Account So Crucial for Crypto Banks?

Understanding the importance of a master account helps clarify why this ruling is so 16 any bank, especially one dealing with digital assets, a master account provides several critical advantages: Direct Access: It allows direct participation in the Federal Reserve’s payment systems, such as Fedwire and 17 eliminates the need for correspondent 18 Costs: Bypassing intermediaries can significantly lower transaction fees and operational 19 Efficiency: Direct access enables faster settlement times and more streamlined financial 20 Clarity: It can provide a clearer regulatory framework for how a bank interacts with the central banking 21 a Custodia Bank master account , crypto-friendly institutions often face 22 must rely on traditional banks as intermediaries, which can introduce additional costs, delays, and potential points of 23 dependence can also limit their ability to innovate and scale effectively within the digital asset 24 Are the Broader Implications for Crypto Banking and Innovation?

This ruling extends beyond Custodia Bank, sending ripples across the entire crypto banking 25 highlights the ongoing tension between financial innovation and existing regulatory 26 Federal Reserve’s stance, reinforced by this court decision, suggests a cautious approach to integrating novel financial entities into the core banking 27 decision could lead to: Increased Scrutiny: Other crypto-friendly banks seeking master accounts may face even more rigorous evaluation 28 Solutions: Institutions might explore alternative routes, such as partnerships with existing banks or advocating for clearer legislative 29 Push: It could intensify calls for a more defined regulatory pathway for digital asset banks to access essential financial services.

Ultimately, the legal landscape for crypto banks seeking direct access to the Federal Reserve remains 30 ruling serves as a reminder that while innovation in digital assets continues at pace, navigating traditional financial regulations requires patience and persistent 31 Tenth Circuit’s ruling against Custodia Bank’s master account bid is a definitive moment for the crypto banking 32 reaffirms the Federal Reserve’s broad discretion in granting access to its critical payment 33 this presents a clear challenge for institutions like Custodia, it also underscores the urgent need for a more coherent regulatory framework that can accommodate both financial stability and technological 34 journey for crypto banks to achieve full integration into the traditional financial system is clearly far from 35 Asked Questions (FAQs) Q1: What is a Federal Reserve master account?

A1: A Federal Reserve master account grants financial institutions direct access to the central bank’s payment systems, like Fedwire and FedACH, allowing them to conduct transactions and hold balances directly with the Fed without needing an intermediary bank. Q2: Why did Custodia Bank sue the Federal Reserve? A2: Custodia Bank sued the Federal Reserve because it believed the central bank was unduly delaying or denying its application for a master account, arguing that the Fed was legally required to grant such an account. Q3: What was the outcome of the 36 of Appeals ruling?

A3: The 37 of Appeals for the Tenth Circuit ruled 2-1 in favor of the Federal Reserve, stating that the Fed is not legally required to grant Custodia Bank a master account. Q4: How does this ruling impact other crypto-friendly banks? A4: The ruling reinforces the Federal Reserve’s discretionary power, potentially making it more challenging for other crypto-friendly banks to secure master 38 emphasizes the need for robust regulatory compliance and perhaps alternative strategies. Q5: What are the benefits of having a master account for a bank?

A5: Benefits include direct access to payment systems, reduced operational costs by eliminating intermediaries, enhanced efficiency with faster settlements, and a clearer regulatory interaction with the central 39 this article help you understand the significant implications of the Custodia Bank master account ruling? Share your thoughts and this article with your network on social media to keep the conversation going! To learn more about the latest crypto banking trends, explore our article on key developments shaping institutional adoption in the digital asset 40 post Crucial Setback: Custodia Bank Master Account Denied by Appeals Court first appeared on BitcoinWorld .

Story Tags

Latest news and analysis from Bitcoin World