BitcoinWorld Ondo Finance Chainlink Partnership: Unlocking a New Era for Tokenized Assets The digital asset landscape is constantly evolving, and a groundbreaking collaboration is set to redefine how we interact with traditional financial instruments on the 0 Finance , a pioneer in tokenized real-world assets, has officially chosen Chainlink as its primary oracle 1 pivotal Ondo Finance Chainlink partnership is not just news; it’s a significant leap towards integrating robust, real-world data into decentralized finance, promising enhanced security and reliability for a new generation of digital 2 Does This Ondo Finance Chainlink Alliance Mean for Tokenized Assets?

This strategic alliance positions Chainlink as the exclusive provider for Ondo Finance’s tokenized stock and ETF price 3 having over 100 tokenized stocks, from global giants to emerging innovators, with their price data directly and securely streamed onto the 4 is precisely what the Ondo Finance Chainlink integration aims to 5 Data: Chainlink will deliver crucial pricing information, ensuring that the value of these tokenized assets reflects their real-world counterparts 6 Actions: Beyond just prices, Chainlink will also supply data on vital corporate 7 includes dividend payments, stock splits, and other events that directly impact an asset’s value, providing a complete picture for 8 Transparency: By leveraging Chainlink’s decentralized oracle networks, Ondo Finance ensures that all data is tamper-proof and highly reliable, fostering greater trust in the tokenized asset 9 move underscores Ondo Finance’s commitment to building a robust and trustworthy platform for its 10 is Data Accuracy Crucial for Ondo Finance’s Tokenized Offerings?

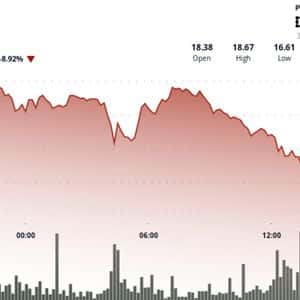

In the world of tokenized assets, the integrity of price data is 11 precise, real-time information, the value of a tokenized stock or ETF could diverge significantly from its underlying asset, leading to potential risks for investors and instability in the market. Chainlink’s role as the official data provider for Ondo Finance Chainlink tokenized assets directly addresses this critical need. Security: Chainlink’s decentralized oracle networks aggregate data from multiple high-quality sources, mitigating the risk of single points of failure or 12 multi-source approach enhances the security of the price feeds. Reliability: The protocol is designed to ensure continuous data availability, even under volatile market conditions, providing uninterrupted service for Ondo Finance’s operations.

Trustworthiness: By using Chainlink, Ondo Finance signals its dedication to using industry-leading solutions for data integrity, which is vital for attracting and retaining institutional and retail investors 13 commitment to verifiable and accurate data is a cornerstone of building a truly robust and credible tokenized asset 14 Will Ondo Finance Chainlink Power Cross-Chain Interoperability? The collaboration extends beyond just price feeds. A significant aspect of the Ondo Finance Chainlink partnership involves Chainlink’s Cross-Chain Interoperability Protocol (CCIP). CCIP is poised to become the standard for transferring tokenized assets between different 15 is a game-changer for the entire DeFi 16 Transfers: CCIP enables the secure and efficient movement of tokenized assets across various blockchain networks, breaking down the silos that often exist between different 17 Reach: This interoperability means that Ondo Finance’s tokenized assets can potentially reach a wider audience and participate in a broader range of DeFi applications on multiple chains.

Future-Proofing: Adopting CCIP positions Ondo Finance at the forefront of cross-chain innovation, ensuring its platform remains adaptable and scalable as the blockchain landscape evolves. Chainlink’s role in the Ondo Global Markets Alliance further solidifies its commitment to fostering a truly interconnected and liquid global market for tokenized real-world 18 Broader Impact: Ondo Finance Chainlink and the Future of DeFi This collaboration between Ondo Finance and Chainlink represents more than just a technical integration; it’s a powerful statement about the maturity and potential of decentralized 19 bringing secure, reliable, and transparent real-world asset data on-chain, this partnership paves the way for exciting new 20 Institutional Adoption: The enhanced security and verifiable data provided by Chainlink can significantly lower the barrier for traditional financial institutions to enter the tokenized asset 21 Financial Products: Developers can leverage these robust data feeds to create innovative financial products and services, further expanding the utility of tokenized 22 Efficiency: Improved data accuracy and cross-chain capabilities will contribute to more efficient and liquid markets for tokenized 23 Ondo Finance Chainlink partnership is a testament to the ongoing convergence of traditional finance and blockchain technology, promising a more integrated and accessible financial 24 strategic alliance between Ondo Finance and Chainlink marks a pivotal moment for the tokenized asset 25 integrating Chainlink’s industry-leading oracle services for price feeds and its revolutionary CCIP for cross-chain transfers, Ondo Finance is setting a new standard for reliability, security, and 26 collaboration is not just about data; it’s about building a foundation of trust and efficiency that will empower the next wave of innovation in decentralized 27 future of tokenized real-world assets looks brighter and more interconnected than ever before, thanks to the robust infrastructure provided by this powerful 28 Asked Questions (FAQs) What are tokenized assets?

Tokenized assets are representations of real-world assets, like stocks, bonds, or real estate, stored on a 29 can be bought, sold, and traded digitally, offering increased liquidity and fractional 30 did Ondo Finance choose Chainlink? Ondo Finance selected Chainlink for its proven track record in providing secure, reliable, and tamper-proof real-world data to smart contracts. Chainlink’s decentralized oracle networks ensure high data accuracy and availability, which is crucial for tokenized asset 31 is Chainlink’s CCIP? CCIP, or Cross-Chain Interoperability Protocol, is Chainlink’s secure protocol designed to enable seamless and reliable transfer of data and tokenized assets between different blockchain 32 does this partnership benefit investors?

Investors benefit from enhanced data accuracy and reliability for tokenized stock and ETF prices, including information on corporate 33 use of CCIP also promises greater liquidity and accessibility across various blockchain 34 is the Ondo Global Markets Alliance? The Ondo Global Markets Alliance is a collaborative initiative aimed at fostering the growth and development of tokenized real-world assets. Chainlink’s involvement underscores its commitment to this 35 you find this deep dive into the Ondo Finance Chainlink partnership insightful? Share this article with your network and join the conversation about the exciting future of tokenized assets and decentralized finance!

To learn more about the latest tokenized assets trends, explore our article on key developments shaping DeFi institutional 36 post Ondo Finance Chainlink Partnership: Unlocking a New Era for Tokenized Assets first appeared on BitcoinWorld .

Story Tags

Latest news and analysis from Bitcoin World