Quick Facts: 1️⃣ Over $8.3B in real-world assets are already tokenized on-chain and growing fast. 2️⃣ Banks like Goldman Sachs and BNY Mellon are integrating blockchain custody for Treasuries and money-market funds. 3️⃣ $HYPER, $BEST, and $LINK are well-positioned to benefit from the next phase of tokenization. 4️⃣ The shift from DeFi 1 to DeFi + TradFi marks a new era in digital finance. Crypto’s been around for nearly two decades, and in that time, we’ve seen narratives 2 back in the beginning, DeFi (decentralized finance) and TradFi (traditional finance) were supposed to be 3 would grow and develop into a rival financial system, providing all the advantages that TradFi lacked: transparency, accountability on the blockchain, natively-digital assets, and more.

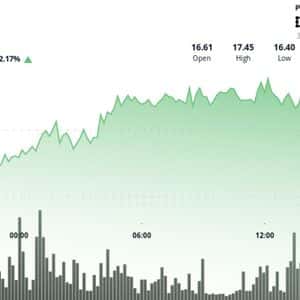

That’s not what we see today. Instead, TradFi looked around, saw DeFi – and liked what it saw. Now, big banks and financial institutions are adopting crypto left, right, and center – and tokenized assets lead the way, particularly tokenized US treasuries, long since a favorite tool of the financial 4 to recent figures, approximately $8.3B in Treasuries have already been tokenized on-chain, with broader estimates putting the total closer to $24-30B. For years, institutions such as Goldman Sachs and BNY Mellon shunned crypto custody, citing regulatory and accounting burdens.

Today, they are tokenizing money-market funds, short-term government debt and other liquid assets that naturally fit the blockchain 5 logic is operational rather than speculative: tokenized funds enable corporate treasurers to move cash faster, pledge assets more flexibly and settle trades outside the usual cut-off 6 you’re a large, multi-national corporation moving large volumes of cash and securities, those benefits are highly 7 tokenization requires custody – holding both the underlying assets (the treasuries themselves, for instance) and the resulting tokens. That’s where the story gets interesting, as the race for custody heats up. Crypto-native firms like Coinbase, with $246B in assets under custody , and Fidelity Investments currently dominate crypto asset custody, charging fees in the order of 0.05%-0.15% of asset 8 tokenized assets scale, those fee revenues add up; if tokenized cash and Treasuries continue to grow from $8B now to reach $25-40B, annual revenues of $300-600M would flow into crypto 9 has the crypto knowledge and infrastructure, but banks already have the client base, trust relationships and regulatory permissions to hold large balance 10 they can integrate tokenization into existing custody services , they could capture a major part of that value 11 is growing at a phenomenal 12 2024 alone : Total market cap of tokenized assets increased by 32% Tokenized treasuries surged by 179% Private credit grew 40% Commodities increased 5% Each of those categories is expected to report even greater growth in 13 tokenization booms and banks turn their eyes towards crypto, what are the best crypto to buy now ?

Look for $HYPER , $BEST , and $LINK to potentially grow by 10x or more as tokenization takes 14 Hyper ($HYPER) – Canonical Bridge to Bitcoin’s Layer-2 Next Chapter Bitcoin Hyper ($HYPER) serves as a next-generation Layer-2 scaling solution that merges the security of Bitcoin with the high-speed architecture of the Solana Virtual Machine (SVM). Designed with a Canonical Bridge, it enables $BTC to be wrapped, staked, and transacted on a high-throughput Layer 2, allowing near-instant payments, DeFi integration, and complex smart 15 is $HYPER? A next-level advance that addresses Bitcoin’s two greatest limitations: transaction speed and network congestion, and lack of 16 introducing ZK-based validation and cross-chain consensus, it unlocks thousands of transactions per second while maintaining a cryptographic link to the Bitcoin 17 can stake $HYPER to earn yield, participate in governance, and use their $BTC in DeFi ecosystems for the first time at 18 over $24M raised in its presale, Bitcoin Hyper is emerging as one of 2025’s most anticipated projects, with nearly $25M raised so 19 $HYPER price prediction expects Bitcoin Hyper could reach $0.20 by the end of 2026, up 1,425% over the current price of $0.013155.

Learn how to buy Bitcoin Hyper and visit the presale page to learn 20 Wallet Token ($BEST) – Non-Custodial Wallet Ready for Tokenization Best Wallet ($BEST) powers a non-custodial, multi-chain Web3 wallet built for the current wave of crypto adoption and 21 platform integrates DeFi, token swaps, NFT storage, and advanced crypto presale access within a single mobile interface. It’s a potent combo of user-friendly simplicity with advanced on-chain 22 $BEST token drives the wallet’s reward ecosystem, offering staking APY, governance rights, and launchpad access for early-stage token 23 project’s roadmap emphasizes interoperability across Ethereum, BNB Smart Chain and Solana 24 chains will be added as the project 25 can also leverage Best Wallet’ s multi-wallet capacity to create up to five individual wallets within the app, allowing them to group tokens according to 26 self-custody and digital-asset security gain mainstream attention, $BEST is positioned to become the utility backbone of a wallet 27 presale, currently at $16.6M, offers tokens for $0.025835.

That $BEST price is predicted to rise to $0.072 by the end of the year, delivering 178% gains for current 28 the Best Wallet Token presale page for the latest 29 ($LINK) – Oracles that Power DeFi and TradFi Adoption Chainlink ($LINK) is rapidly transitioning from being a leading blockchain oracle network to a pivotal bridge between legacy finance and decentralized systems: Chainlink collaborated with SWIFT to allow banks to continue using ISO 20022 message formats, while triggering on-chain events via Chainlink’s architecture, meaning institutions can keep familiar processes and rails while adopting tokenized 30 also introduced the ‘Digital Transfer Agent’ (DTA) technical standard, which enables fund administrators and custodians to manage tokenized fund subscriptions and redemptions in the same way they do today — but now on-chain.

A major initiative with 24 global financial institutions, including DTCC and Euroclear, aims to standardize corporate-actions data on-chain and streamline asset-servicing 31 explicitly links their own development to asset 32 a recent conference, founder Sergey Nazarov demonstrated just how big the potential market is: Markets worth hundreds of trillions are all in play – and Chainlink intends to open them all to crypto. What’s happening with TradFi and DeFi may appear 33 money-market funds isn’t 34 the underlying implication is profound: banks are positioning to become the custodians and operational backbone of the next generation of digital 35 flows of tokenized assets – not just the headline amounts – will determine who controls balance sheets of the future, and $BEST , $LINK, and $HYPER are all poised to play active 36 always, do your own 37 isn’t financial 38 by Bogdan Patru for Bitcoinist – 0

Story Tags

Latest news and analysis from Bitcoinist