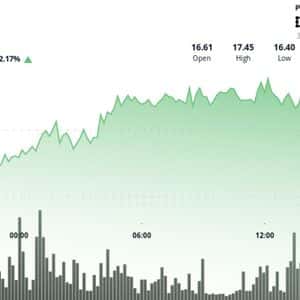

The cryptocurrency market flashed recovery signals today as Bitcoin reclaimed $113,000. As risk-on sentiments emerge, BitMEX co-founder Arthur Hayes has issued an ambitious vision for the altcoin 0 Hayes believes Hyperliquid’s (HYPE), Ethena (ENA), and 1 (ETHFI) has all it takes to outperform the market in the coming years, with up to 126x by 2 bold predictions have raised eyebrows, especially due to cryptocurrencies’ inherent volatility and wild fluctuations. However, Hayes has tied his forecasts to user behavior, macroeconomic trends, and intensifying innovations in the DeFi space. Let’s discover 3 to outshine Binance Decentralized exchange Hyperliquid has thrived lately, due to its high-frequency trading 4 native token, HYPE, hit new all-time highs this week as it rallied despite broader market struggles.

Meanwhile, Hayes believes Hyperliquid has just 5 expects the DEX to rival and finally dethrone Binance as the largest exchange by trading 6 BitMex co-founder highlighted Hyperliquid’s execution as a winning 7 most DEXs move slowly, Hyperliquid boasts a pace that matches top CEX 8 HIP3 rollout is transforming HYPE’s platform into a permissionless ecosystem for spot and derivatives trading, promising deep liquidity and real-time 9 by a highly efficient team led by Jeff Yan, Hyperliquid is rising as a dominant player in derivatives trading , currently accounting for 67% of DEXs’ market 10 to Hayes: Hyperliquid is so transformational that it is quickly growing against CEXs like 11 the end of this cycle, Hyperliquid will be the largest crypto exchange of any type, and Jeff Yan might become richer than CZ, the founder and former CEO of 12 traded at $48 after gaining over 20% the previous 13 forecasts $126x for the Hyperliquid’s token as global traders move 14 and USDe’s momentum Hayes also spotlighted Ethena (ENA), the issuer of the thriving synthetic stablecoin 15 has grown to become the 3rd-largest stablecoin by circulating supply in less than two 16 American billionaire trusts USDe’s continued upgrades and growth trajectory could see it surpassing USDC to take the second spot behind Tether’s 17 projects it capturing around 25% of stablecoins’ market share, with approximately $2.5 trillion.

Ethena’s yield-generating model stands out due to advanced strategies like shorting futures against spot tokens and “cash & carry” 18 blockchain offers lucrative earning opportunities for stablecoin holders that traditional alternatives like US Treasury bills do 19 stablecoin sector has seen massive growth after the US regulation, with its total supply exceeding the $280 billion market cap for the first time 20 trades at $0.6684 after an 8% rally in the past 24 21 forecasts a 51x rally from its current levels. Ether. fi: integrating stablecoins to day-to-day spending The third project that Hayes analyzed was Ether. fi, the platform bringing stablecoins to real-world 22 blockchain offers a Visa-powered card that allows users to spend crypto at global enterprises accepting 23 positions Ethena to spearhead the long-awaited real-world utility of 24 expert said: The customer experience, whether I use my Amex or 25 cash card is the 26 is important because, for the first time, many in the Global South will pay for goods and services anywhere in the world powered by stablecoins and 27 predicts 34x growth for ETHFI as stablecoins dominate the international financial 28 Hayes’ forecasts echo most cryptocurrency maxis and analysts, digital assets remain 29 your research.

Story Tags

Latest news and analysis from Invezz