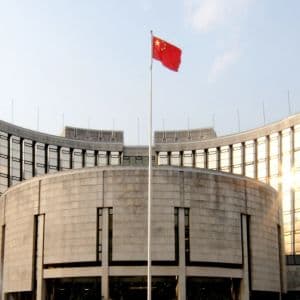

China’s central bank introduced new rules to oversee cross-border yuan deals between banks and boost the yuan’s use abroad, aiming to steady money flows and support offshore 0 a notice outlining the proposals, the People’s Bank of China said it plans to add a counter-cyclical tool to manage interbank, cross-border yuan 1 mechanism is meant to temper swings and guide activity through the 2 central bank also said it wants Chinese lenders to make fuller use of this 3 will set a cap on related business that still leaves “adequate room for growth,” giving banks space to expand while keeping overall risk in 4 to the PBOC , the draft rules are intended to “further support cross-border yuan financing by domestic banks, develop the offshore yuan market, and improve macro-prudential management of cross-border capital flows.” Reports claim that the goal is to shore up the plumbing that moves yuan across borders while safeguarding financial stability.

Cross-border yuan financing, covering loans as well as bond repurchase agreements, is the main avenue for onshore banks to send liquidity to offshore 5 supplying funding to those markets, lenders help support the currency’s use 6 outreach is also 7 8 said on Thursday that Treasury Secretary Scott Bessent will meet Chinese Vice Premier He Lifeng and other senior officials next week in Madrid to keep talks going on trade, the economy and national security 9 sentiment turns bullish on yuan prospects In markets, some investors see room for a much stronger Chinese 10 Jen, chief executive of Eurizon SLJ Capital, said the yuan could stage a large rally as authorities face pressure to allow 11 currency is up about 2.4% against the dollar this year, but it has fallen versus several other major peers because the dollar’s drop elsewhere has been even 12 has created the impression of an “opportunistic devaluation,” he said, warning of possible pushback from key trading 13 yuan traded near 7.13 per dollar on Monday.

“The low 6s would make more sense than where we are now,” Jen said, noting his “dollar smile” framework. “A more reasonably priced renminbi and a less predatory exchange rate policy would earn China some good will from the rest of the world.” Positioning has turned more 14 funds have bought bullish options after recent weak 15 figures, and a sharp equity rally has raised doubts about how much more monetary easing is likely, both factors seen as supportive for the 16 weighted yuan still down despite dollar weakness Bank of America and Deutsche Bank also look for gains, though they target a milder 6.7 per dollar over the next year or 17 March, Jen argued the dollar was about 20% too high and set for a multi-year 18 19 has also logged its longest losing streak since April 2023, providing a supportive backdrop for the yuan, as reported by 20 Europe’s common currency, the yuan has slipped about 9.6% this year and more than 5% versus the British 21 a trade-weighted basis, it is down around 4.6%.

Jen adds that Chinese firms hold roughly $2.5 trillion of liquid assets overseas that could be repatriated, while a further stock surge could invite more 22 CSI 300 has risen more than 20% since April lows. “China’s financial assets remain undervalued but also under-owned,” he said. “Renminbi appreciation could help China attract some foreign investment back to the financial markets.” Don’t just read crypto 23 24 to our newsletter. It's free .

Story Tags

Latest news and analysis from Cryptopolitan